UK State Pension: Are you curious about your future State Pension in the UK? It’s never too early (or too late) to start planning for your retirement. Checking your State Pension forecast can give you a clear picture of what to expect and help you make informed decisions about your financial future. Let’s walk through the process together, step by step, in a friendly and straightforward manner.

Table of Contents

What is the UK State Pension?

First things first, let’s talk about what the State Pension is. The State Pension is a regular payment you can claim when you reach State Pension age, provided you’ve made enough National Insurance contributions during your working life. It’s a significant part of many people’s retirement income, so knowing how much you’ll get is essential.

Why Check Your State Pension Forecast?

Checking your State Pension forecast is like peeking into your financial future. It helps you understand:

- How much State Pension you could get: This figure is based on your National Insurance record.

- When you can get it: Your forecast will tell you your State Pension age.

- How to increase it: If you’re not on track for the full amount, your forecast will provide options to boost your future payments.

How to Check Your State Pension Forecast

Checking your State Pension forecast is easier than you might think. You can do it online, over the phone, or by post. Here’s how:

Online

- Go to the Gov.uk website: Navigate to the State Pension forecast page.

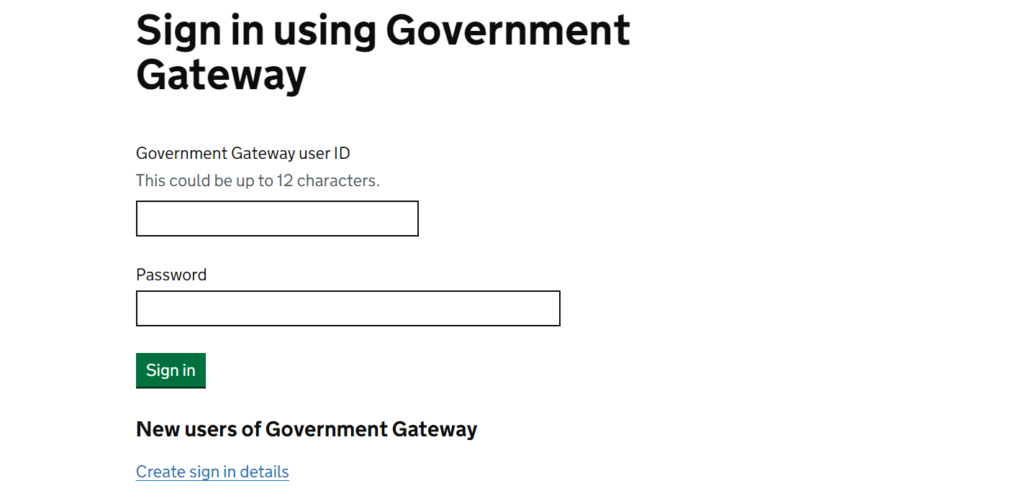

- Sign in or create an account: You’ll need to sign in with your Government Gateway or verify your identity using GOV.UK Verify.

- Follow the prompts: Once logged in, follow the steps to view your State Pension forecast.

Direct link for checking your state pension online: Click Here

Over the Phone

If you prefer to speak to someone, you can call the Future Pension Centre. They’ll ask for some details to verify your identity and then provide your forecast.

By Post

You can also request a paper statement by post. Download the BR19 application form from the Gov.uk website, fill it out, and send it to the address on the form. You’ll receive your forecast in the mail.

Understanding Your Prediction

Your State Pension forecast will include a few key pieces of information:

- Estimate of your State Pension: This is how much you could get per week.

- State Pension age: This is when you can start claiming your pension.

- National Insurance record: This shows your contributions and any gaps.

What If There Are Gaps?

Gaps in your National Insurance record can affect your State Pension amount. But don’t worry, there are ways to fill these gaps:

- Pay voluntary contributions: If you can afford it, paying voluntary National Insurance contributions can help increase your pension.

- Claim National Insurance credits: If you’ve been unemployed, a carer, or on certain benefits, you might be eligible for credits that fill gaps in your record.

Boosting Your State Pension

If your forecast shows you’re not on track for the full State Pension, here are a few tips to boost it:

- Continue working: Each additional year of National Insurance contributions adds to your pension.

- Check for eligible credits: Make sure you’re receiving all the National Insurance credits you’re entitled to.

- Consider deferring your pension: If you defer claiming your State Pension, it can increase by 1% for every nine weeks you delay.

Conclusion

Checking your State Pension forecast is a smart move. It gives you a clearer picture of your future finances and helps you make informed decisions about your retirement planning. Whether you do it online, over the phone, or by post, understanding your State Pension can give you peace of mind and help you plan a comfortable retirement.

So, why wait? Take a few minutes today to check your State Pension forecast and take control of your financial future!